CSS Solved Business Administration Past Papers | Discuss the three common capital budgeting decision techniques with examples and formulas.

The following question is attempted by Miss Nimra Masood, the top scorer in CSS Business Administration papers. Moreover, the answer is written on the same pattern, taught by Sir to his students, scoring the highest marks in compulsory subjects for years. This solved past paper question is uploaded to help aspirants understand how to crack a topic or question, how to write relevantly, what coherence is, and how to include and connect ideas, opinions, and suggestions to score the maximum.

Topic Breakdown

The three capital budgeting techniques are payback period, net present value and Internal rate of return. The concept and formulas of capital budgeting must be clear to students as it is often given in CSS exams.

Topic: Capital Budgeting

Subject: Financial Management

Introduction:

Capital budgeting is one part of financial management. It is very crucial for investors. Before investing in the project, stakeholders need a clear view of the viability of the project. The three capital budgeting techniques are Payback Period, Net Present Value and Internal Rate of Return. All three combined give an illusive overview of the viability of the project.

Data for Calculating Payback Period, NPV and IRR:

| Year | Cash flow | Amount |

| 0 | Initial Cash flow | (100000) |

| 1 | Cash flow 1 | 35000 |

| 2 | Cash flow 2 | 38000 |

| 3 | Cash flow 3 | 41000 |

| 4 | Cash flow 4 | 39000 |

Three Capital Budgeting Techniques:

1) Pay Back Period:

It is the simplest way to determine the viability of a new asset investment. This method determines the time period in which the asset cost will be recovered from its operational benefits. The quicker the payback period more viable the project is.

- Formula:

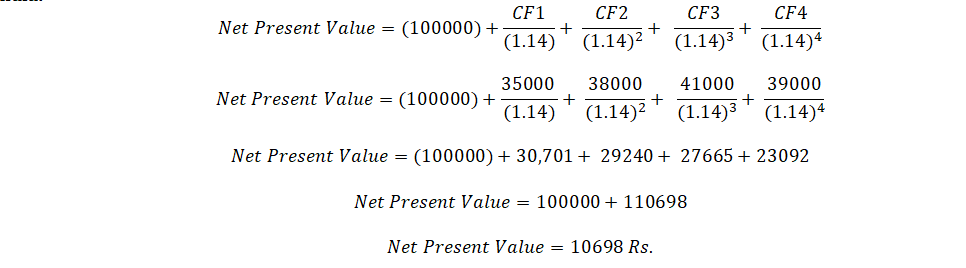

2) Net Present Value:

The second Technique of capital budgeting is the net present value. The worth of money does not remain the same over a period of time. This method uses discounted cash flows to account for inflation and other factors. This technique gives us a summary if the project will be profitable in future or not. However, one big drawback is that it is totally based on the assumption

To calculate NPV for the above cash flows, lets assume a required rate of return to be 14%

- Formula:

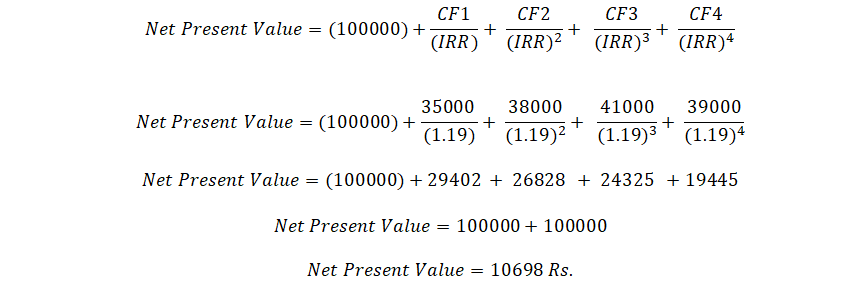

3) Internal Rate of Return:

The most complex and reliable of the three techniques is the internal rate of return. In this method, the rate of return on asset is compared to the financing cost. If the rate of return is more than the cost, then the project is viable.

- Formula:

Hence, if the cost of the project is above IRR, then the project is not profitable.

CSS Solved Past Papers’ Essays

Looking for the last ten years of CSS and PMS Solved Essays and want to know how Sir Kazim’s students write and score the highest marks in the essays’ papers? Then, click on the CSS Solved Essays to start reading them.

CSS Solved Essays

CSS Solved General Science & Ability Past Papers

Want to read the last ten years’ General Science & Ability Solved Past Papers to learn how to attempt them and to score high? Let’s click on the link below to read them all freely. All past papers have been solved by Miss Iqra Ali & Dr Nishat Baloch, Pakistan’s top CSS GSA coach having the highest score of their students.

General Science & Ability Solved Past Papers

CSS Solved Pakistan Affairs Past Papers

Want to read CSS Pakistan Affairs Solved Past Papers and learn how to attempt them to score high? Let’s click on the link below to read them all freely. All past papers’ questions have been attempted by Sir Kazim’s students, who scored the highest in the subject.

CSS Solved Pakistan Affairs

CSS Solved International Relations’ Past Papers

Have you opted for International Relations in the CSS examination and want to score above 150? Then, click on the CSS Solved International Relations’ Past Papers by Miss Abeera Fatima, the top IR scorer and the best IR coach in Pakistan.

CSS Solved International Relations Past Papers

Articles Might Interest You!

The following are some of the most important articles for CSS and PMS aspirants. Click on any to start reading.